Can You Make a Living? Exploring Viable Income Pathways

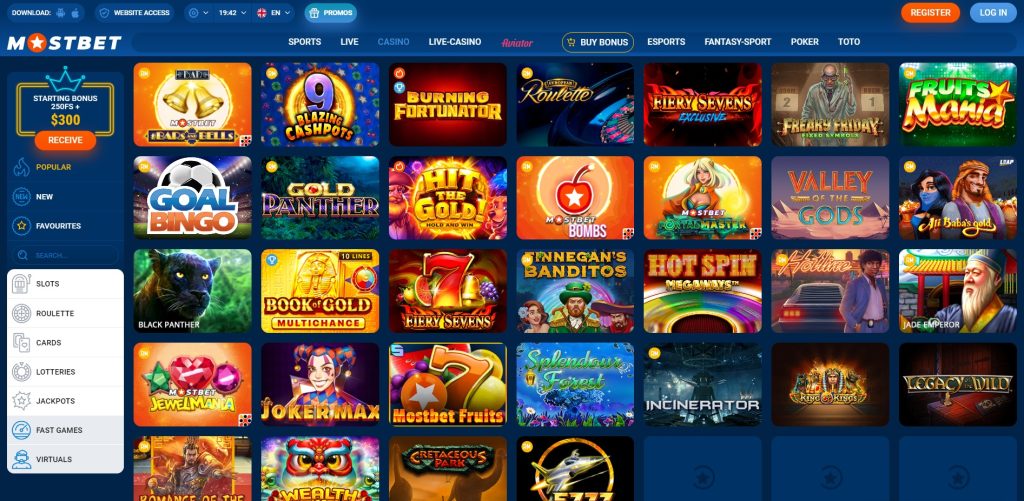

In today’s fast-paced world, the question arises: Can You Make a Living Playing Online Casinos in Bangladesh in 2026? Mostbet? The answer is complex and multifaceted. While some may find traditional employment sufficient for their needs, others may discover that alternative pathways offer more flexibility and potential for income growth. This article delves into various options available for making a living, analyzing the pros and cons of each.

Understanding Traditional Employment

For many people, the traditional route of securing a full-time job with a company is the most common way to earn a living. This path provides a steady paycheck, benefits such as health insurance, retirement contributions, and a clear career path. The stability that comes with traditional employment can be appealing, especially for those who prioritize financial security. However, the downside includes limited flexibility in work hours and potential stagnation in career growth. The reliance on a single income source can also be risky if job security is threatened during economic downturns.

Exploring Freelancing

Freelancing has emerged as a popular alternative to traditional employment. With freelancing, individuals can offer their skills and services on a contractual basis, often enjoying a greater degree of freedom in choosing their projects and work hours. This approach appeals to a growing number of people, especially in industries like creative arts, writing, programming, and consulting. Some benefits include setting your rates, working from anywhere, and the opportunity to take on multiple clients.

However, freelancing is not without its challenges. Income can be unpredictable, especially when starting out or during economic downturns. Freelancers are also responsible for finding their clients, managing their own taxes, and securing their health insurance. Without the support of a company backend, many freelancers find themselves burdened by administration and uncertainty, which can lead to stress and anxiety.

The Entrepreneurial Path

Entrepreneurship is another avenue that many consider for making a living. Starting your own business can be incredibly rewarding, allowing for creative expression and the chance to build something from the ground up. Entrepreneurs enjoy the flexibility of setting their own hours and making decisions that align with their vision.

However, entrepreneurship comes with considerable risks. It often requires a significant initial investment and a strong commitment to long hours, especially during the startup phase. According to statistics, a large percentage of new businesses fail within the first few years, which underscores the potential financial risks involved.

Online Opportunities

The internet has opened doors to numerous ways to make a living. Online opportunities, such as e-commerce, content creation, affiliate marketing, and tutoring, offer endless possibilities for income generation. One of the most appealing aspects of online work is the ability to reach a global audience, enabling individuals to diversify their income streams.

Content creation, such as blogging or vlogging on platforms like YouTube, allows individuals to monetize their passions and hobbies. On the other hand, e-commerce enables people to start their retail businesses with lower overhead costs. However, these routes also require careful planning, marketing skills, and often face stiff competition.

Investing as a Means of Income

Investing is another method through which people can generate a living. Whether through real estate, stocks, or other assets, savvy investing can yield significant returns over time. Many people have transitioned from traditional jobs to focusing on investment portfolios as their primary source of income.

Nevertheless, investing requires capital, knowledge, and risk tolerance. The stock market is unpredictable, and real estate requires market savvy and potentially significant capital upfront. Therefore, it’s crucial for aspiring investors to educate themselves and possibly consult with financial advisers before diving in.

The Gig Economy

The gig economy offers countless short-term employment opportunities, through platforms that connect freelancers with clients, such as Uber, Lyft, and TaskRabbit. This convenient model allows individuals to take on as much or as little work as they desire, often fitting around other commitments.

However, gig workers often lack benefits and job security, with income varying significantly from month to month. While some thrive in this environment, others may find the uncertainty challenging, leading to a delicate balance between work and life stress.

Conclusion

In conclusion, the question of whether one can make a living depends largely on individual circumstances, skills, and preferences. Traditional employment offers stability, while freelancing and entrepreneurship provide flexibility and the potential for higher income. Online opportunities continue to grow, providing new ways to generate revenue, and investing can add another layer of financial security.

The best approach is to explore multiple avenues, combining them to create a diverse income portfolio that minimizes the risk associated with relying on a single source. By assessing your strengths, passions, and goals, you can pave your way toward a fulfilling career that not only meets your financial needs but also aligns with your lifestyle aspirations.